|

The reason I’m offering you a small crossword puzzle this month is that the tag line for my website at www.coachingwithloretta.com is: "Life’s a puzzle and sometimes you just need |

| Across 2. What you will need to get you up every morning. 4. It’s not just about the money. 5. Seeing the glass half full shows you are full of this. 6. Make new ones and keep the old. | Down 1. When you have this, you have everything. 2. This puts you on your path to success. 3. Asking what? Who? Why? - Describes this important trait. |

P.S. This column was originally written for The Observer, but I have created a PDF version of the crossword puzzle that you can print out. You can download it here.

There is no right or wrong way to do it. There is no required length. You can jot down, draw pictures, create paragraphs, poems, or even lyrics reflecting your thoughts and feelings. (Think Taylor Swift!) The only strong suggestion is that research has shown writing daily (or almost every day) offers much greater results.

For the purpose of any life transition – and especially relating to retirement -journaling is extremely beneficial because it:

- can help you set and accomplish goals.

- is a place to express gratitude.

- puts you in the present instead of the past.

- allows you to express your true thoughts and feelings.

By the way, no one else reads it. It’s yours to keep and reread if you like or to simply embrace the time as private minutes between you and your thoughts and feelings.

Happy Journaling!

| Across 2. purpose 4. retirement 5. positivity 6. friends | Down 1. health 2. plan 3. curious |

I certainly found it in a recent article on Retirement that I came across in Forbes Magazine. The author, Joseph Coughlin, a well-known researcher, teacher, and head of the MIT Age Lab, talked about “The New Math of Retirement Togetherness.”

[No, this is not an SAT Math question.]

At this point Coughlin went on to narrow things down stating that life routines of home/child/personal responsibilities, etc., result in the fact that the reality is that a typical working couple may often spend only six (6) hours a day together! Quite a surprise when we do the math, right? (see box below)

AN EXTRA 10 WAKING HOURS A DAY

FOR A RETIRED COUPLE

TO SPEND TOGETHER!

These are situations that you and your significant other must consider as retirement comes closer. What if your list of ‘things to do’ doesn’t match that of your partner’s? In fact, do you really want everything on your list to match that of your partner?

I ran into a neighbor and his wife recently. He is an executive who is looking forward to leaving the deadlines and fundraising behind. I asked him how he plans to spend his time, and his wife immediately answered, “He’s going to paint the family room, clean out the garden, and join the choir so we can sing together on Sundays!” I looked at him and he rolled his eyes and said, “Do I have a choice?” The answer is “Yes, you do have a choice.” Discuss it now so you both can enjoy the added time together later.

Loretta

[email protected]

P.S. Last night, before he turned out the light, my husband whispered:

‘A’ squared plus ‘B’ squared = ‘C’ squared!

Sometimes all that’s needed is a little information, right? So, here’s some!

DID YOU KNOW THAT...

Please don’t be a ‘used to be!’ Thinking about who you are NOW and what you want will help you create the things you will be retiring TO.

And, by the way, a Harvard Grant Study has shown that not only did having a strong social connection in retirement help people outlive those who didn’t, but also aided in delaying the onset of Alzheimer’s and dementia!

AND BY THE WAY… one more

Research has shown that when goals are written down, it reminds you of what they are and what you need to do to achieve them! Then put the list in a place where you can easily find it and check your progress.

(Paul Simon Had the Right Idea!)

“JUST MAKE A PLAN, STAN!”

YOU DON’T NEED TO BE COY, ROY.

When you become your own GPS, you will feel much more confident, knowing when and where to spend your time. You’ll do things like committing to your fitness routine and researching some of those ideas and activities that have caught your attention. So,

DON’T SLIP OUT THE BACK, JACK

In addition, knowing how you envision your retirement years will help avoid uncomfortable discussions later. Your partner and/or adult kids will hear and respect your thoughts and needs. (Like No, I’m not taking over all the babysitting responsibilities or Ok, I’ll try pickleball but just remember my guitar lessons are Tuesday at 11:00!) Now, make sure you

DON’T SIT STILL, JILL!

Like leaving a lover, leaving full-time work requires planning. There may be more than 50 ways to do it, and with a little effort you will find yours. Then, at your retirement party you can

JUST EAT YOUR CAKE, JAKE & JILL

Loretta

[email protected]

P.S. By the way, remember that the written plan for retirement can easily be changed if you have some new ideas. Your GPS will just recalculate!

(Author’s note: Sorry, but by the time you read this all slots will have been filled.)

I’m guessing you are familiar with the success of the two previous shows, The Bachelor and The Bachelorette. Well, this version’s contestants are all over 60, and the handsome bachelor making his choice stands by the tagline “It’s never too late to fall in love…, again!”

Maybe you don’t want to publicly be the next GOLDEN BACHELOR or BACHELORETTE, but I’m sure you want the life ahead to be full of connection, meaningful relationships, and the possibility of falling in love … again!

You want that spark that can re-ignite those endless possibilities!

What you really need is a good look at who you are now.

Step One*: Focus on being a positive and optimistic person.

2. You can direct this intentional activity to surrounding yourself with positive people. Recognize the people in your life that bring you down and become unavailable to them. If some are family, make a point of consciously avoiding large amounts of time together.

3. I’m giving you five things to do daily for 30 days that will help you train yourself to Make Happy a Habit!

- Upon waking every morning say out loud three things you are grateful for.

- At bedtime every night, write about a positive experience that occurred in the past 24 hours (one sentence or many about anything positive that occurred.)

- Exercise 20 minutes a day (can be done in two 10 - minute intervals, if necessary)

- Meditate five to seven minutes a day, either with an app (I like HEADSPACE) or just by listening to wordless music.

- Perform a daily random act of kindness. (let someone in front of you in traffic; say something nice to a cashier, etc.)

Loretta

[email protected]

*By the way, Steps Two, Three, and Four are "Repeat Step One."

~~

Lately, I've gotten a lot of requests for my services as a Life/Retirement/Transition Coach. This time, I immediately thought the answer was group coaching.

Normally, I don’t share information about clients, but in order to help you understand that we need to reach out and help each other, I have obtained releases from anyone involved in this note.

Last week I held a group session with five attendees. Each had their own issues, and each was truly concerned. I’m sure you will recognize them:

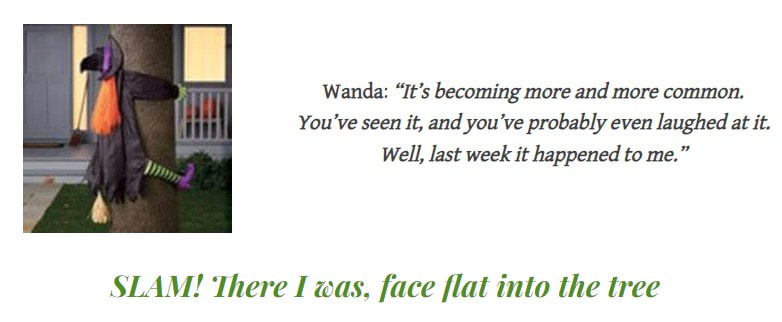

“I was on my broom and one of my earbuds fell out. I had to look down to retrieve it - and SLAM! There I was, face flat into the tree. I heard people laughing! Why didn’t my radar warn me about the tree? Am I getting too old? Should I retire?”

Cornelia: She spoke softly and made eye contact with each member of the group.

“Look, as early as the 1880s I became popular. My three colorful layers are attractive, and I’m small and easy to eat.”

She teared up.

She started to sob.

“I’m fat free and keep in the refrigerator for up to 9 months, but nobody really wants me now... Ok, Ok, I guess I should just retire – right?”

Casper was next.

Casper: "Yeah, it’s not rocket science. You all know me – you know me by my full name, ‘Casper the Friendly Ghost.'"

He started to smile a little, and then the smile faded.

Wanda started to snicker.

“Whoever heard of a friendly ghost?” she muttered. I had to shhh! her.

“And now there is COVID-19,” Casper continued. “People can’t even be with their regular friends, so you can bet no one wants to talk to a friendly ghost! What should I do? I have a lot of years ahead of me!”

Then it was Terry’s turn.

Terry: “Ha – you think you guys have issues? You think you don’t know what to do ‘next’? When I was a little tiny tarantula, my Mama told me I was cute. Then I left the nest, and it all ended.”

He looked around, daring people to challenge him.

Everyone got quiet.

“I know, I crawl; I have long hairy legs, and I have eight eyes. But I’m harmless to people! If I bite, it’s no worse than a bee sting – okay? Look it up! So, what’s a young guy like me to do with a reputation like that?”

Wanda started muttering again. “Maybe you remind people of the COVID virus,” she whispered.

I talked over her. “Ok, Peter, it’s your turn.”

His voice softened.

“But then, enter plastic and inflatables. Enter strange colors and shapes. How can I keep up with those inexpensive, use year-to-year decorations? Even on the flavor side – so many cheaper, easy-to-use imitations! In chips/pancake mix/coffee – even donuts!

People are pumpkin crazy, but they are not using the real thing!”

He looked up at me and sighed.

“And now COVID-19. There used to be pumpkin carving parties. Now no one is gathering groups together to sit close and carve. I may be able to hold out for a few more years, but I need a plan, a new direction. Should I retire?”

I let the air settle for a few minutes. Group sessions are not easy. A person (or a pumpkin) can listen and feel their issue is not so bad, or the participant can take on everyone’s problems and go away feeling worse.

I decided there was only one answer and it applied to the whole group.

As the door shut, I heard Casper shout:

“That was amazing! Ok, everybody, MASKS ON – Let’s have a Group Hug!”

~ HAPPY HALLOWEEN ~

-Loretta

FYI |

Today I’m writing this column while traveling abroad, and I dedicate it to all of you who are saying,

"One of the main things I plan to do

when I retire is TRAVEL."

We all know that Covid caused people to stay home and be cautious. Now the travel light has turned green, postponed trips are back on the books, and everyone is out searching for a new four-wheeled suitcase!

(NOTE: Since most of us would rather not check our new four-wheeled suitcase, please read my list of reminders that follows first while packing, then while practicing pulling your packed case around the house, and finally while picking it up and pretending to squish it into the overhead bin.

Here are four reasons to focus on your fitness

before your dream of retirement travel:

And one more…

BON VOYAGE!

*In Greek mythology Zeus punished Sisyphus by forcing him to roll a boulder up a hill for eternity.

P.S. I’d love to hear your travel stories and how glad you were to have physically prepared for the challenges and the fun.

Tell me: [email protected]

RELATIONSHIPS, COLLEGE, MARRIAGE, PARENTING, EMPTY NESTERS, CHANGING JOBS, RETIREMENT!

- Change refers to the need to move away from the way things used to be to the way they are now.

- Transition is the psychological process we go through to adapt to the change.

To quote the author William Bridges, “Without transition, change is just a rearrangement of the furniture.”

There are three stages to TRANSITION:

Ok, so you have left work. You must accept the fact that your days will be different. You will no longer have the structure, calendar and organization you had before. Where you spend your day, and who you will be with will change.

Yes, you read that correctly. Accepting a Messy Middle is an important mindset to

have. Realizing that things really are different and that it will take time to figure out what you really want and how you will find your purpose to feel satisfied can be a bit uncomfortable (and messy) in the short term.

Take a victory lap! You have figured it out, so find comfort in this new beginning. You also can relax because you realize that you can tweak it along the way as you experience the many new adventures you have been curious about.

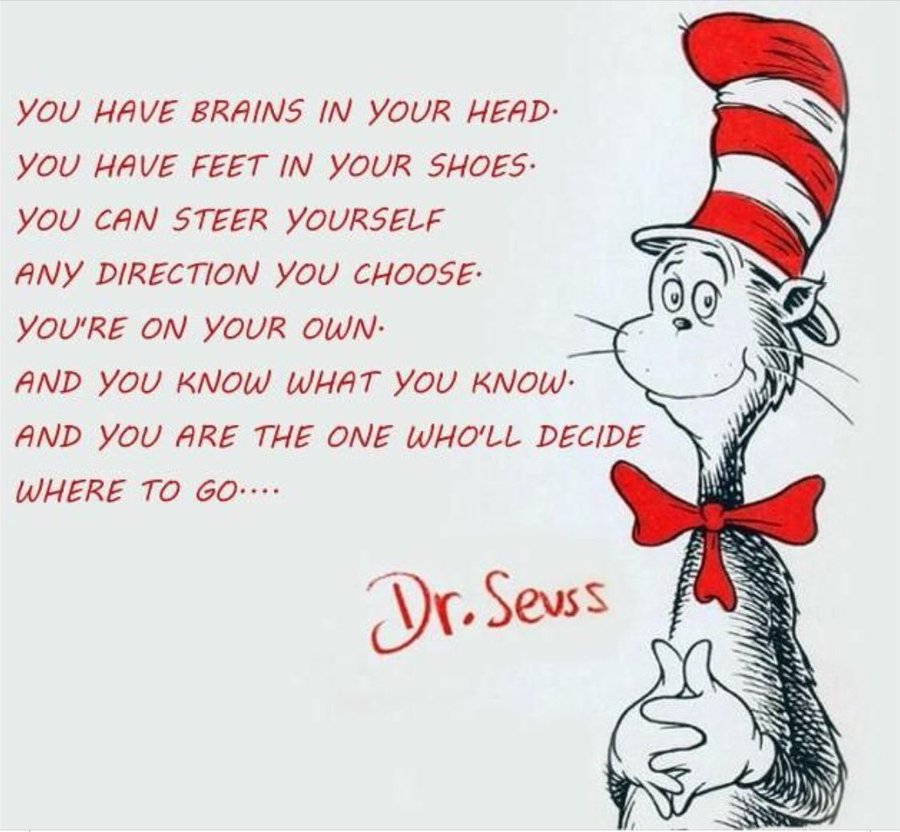

I leave you with the words of Dr. Seuss:

Loretta

Episode 7 of Resources for a Modern Retirement is about the importance of physical fitness in retirement, of course, and at all times in life.

About our Episode Guest

| Mary Cady Bolin |

1. GUESS WHAT Number ... "Retirement" is on the list of 'Life's 43 most stressful life events'.

2. GUESS WHAT … it might mean if your work defines “who you are” rather than “what you do.”

3. GUESS WHAT … will happen if your social connections are mostly related to your workplace.

By the way, a Harvard Grant Study has shown that having a strong social connection in retirement not only helps people outlive those who don’t but also aids in delaying the onset of Alzheimer’s and dementia.

4. GUESS WHAT … sitting at a desk most of the day can cause.

5. GUESS WHAT … believing that “the best is yet to come” can encourage.

6. GUESS WHAT happens … when volunteering is what you want to do in retirement, but you don’t spend any time looking into it beforehand.

Think about what you would like to do for an organization, so you don’t get stuck making phone calls or stuffing envelopes (unless, of course, you like that!).

AND BY THE WAY… one more

7. GUESS WHAT happens … when you WRITE DOWN goals you want to achieve.

Research has shown that when goals are written down, it reminds us of what they are and what we need to do to achieve them. Just make sure you put the list in a place where you can easily find it.

Loretta

Author

Loretta Saff, M.A., CPC, CPRC

As an active writer, both nationally and internationally, Loretta Saff's humor columns, blog, and lifestyle articles reflect an insight in dealing with situations that helps people get to their core issues and encourage confidence, trust and support.

Categories

All

Children

Couples

Decision Making

Grandparenting

Holiday Tips

"Let's Talk Retirement"

Life Strategies

Make Happy A Habit

Modern Retirement

Parenting

Personal Empowerment

Retirement

Social Distancing

Technology

Videos

Zoom

Archives

November 2023

October 2023

July 2023

June 2023

March 2023

December 2022

November 2022

October 2022

September 2022

July 2022

May 2022

March 2022

February 2022

January 2022

December 2021

October 2021

September 2021

July 2021

June 2021

April 2021

March 2021

February 2021

January 2021

September 2020

July 2020

June 2020

April 2020

January 2020

December 2019

October 2019

July 2019

March 2019

February 2019

January 2019

September 2018

August 2018

March 2018

February 2016

RSS Feed

RSS Feed