Episode 6 of Resources for a Modern Retirement breaks down the 9 keys to true wealth and planning for your future self.Where do you want to be in ten years? In today's podcast, join Eric J. Weigel and me, as we navigate how to plan for your future self. Retirement is about more than just money, as Eric identifies in his book, Reimaging Retirement - 9 Keys to True Wealth. Learn about the 9 keys to true wealth and focusing on all areas of your life that are important to you! About Our Episode Guest

0 Comments

While traveling recently, I was introduced to someone from Brazil. When I told him I was a Life Coach with a specialty in Retirement, he was intrigued. The conversation went something like this: He: Interesting. I recently watched a documentary about retirement in the U.S. If you don’t mind, I have a question. Me: Sure, go ahead and ask. He: Well, one thing really surprised me. Is it true when a person retires in the U.S., they are assigned a LEGAL GUARDIAN? A Legal Guardian at Retirement? No!Needless to say, I was surprised. Perhaps the film dealt with financial planning or offered other suggestions for protecting one’s assets during retirement. Somehow, he had come away with a very strange conclusion. Note: Many people in the U.S. take legal steps to assign Power of Attorney to a family member or trusted friend as part of their Estate Planning. This gives that person the legal authority to care for the personal and property interests of someone who has become physically or mentally impaired. A legal guardian is similar in nature, but the guardian is assigned through an extensive court proceeding rather than through the wishes of the individual. Obviously, neither is an automatic factor of retirement. Guard Against the Dark SideWhat I did not share with him - and what I really don’t like to linger on here because our focus in these pages is the power of positivity – is the fact that after retiring some people do experience the dark side of retirement. Simply put, the dark side of retirement has to do with feeling lost, useless, depressed, and simply without validation. Sitting in the house all day with little to do is very boring and lonely; the spiraling down can even lead to exploring the liquor cabinet. For some, the lack of purpose that comes with retirement is very hard and finding the positive can be difficult and they can no longer handle their own affairs. If you or anyone you know is experiencing depression or having trouble shifting a negative mindset, I encourage reaching out to a good therapist or consulting with your primary care physician. There is help! Focus on the Bright SideHappily, what most people can look forward to is the bright side of retirement!And, indeed, there is a bright side – time to do the things you really enjoy, opportunities for creative and exciting adventures, satisfaction of embracing the new and nurturing the tried and true. It involves PLANNING, and there are a few simple things you can do now to make YOUR future look bright. Step One: PHYSICALStart now to build an exercise routine. This does not require a gym membership or a Lulu Lemon outfit. If you are new at it, start with 10 minutes and watch yourself build up to 30. Step Two: MENTALSet your mind to being more positive every day. Make things happen. What are you are really good at and enjoy doing? Spend a little time starting up again. (Photography? Learning a language? Volunteer?) Step Three: SOCIALMake sure your friends and social connections are not all associated with your work. You’ll have new friends thanks to step two! And…, get rid of negativity. If relationships are hard to break, try to interact less often. Step Four: SPIRITUALThis is not an edict for religion. Instead find time to bring significance to your daily routine. How can you contribute? How can you feel satisfied? Oh yes, and perform a random act of kindness every day. That’s it. I’ve tried to make it short and sweet. Whether you are following these suggestions yourself or if you are a Power of Attorney or a Legal Guardian trying to help the person in your care, working through these four steps is bound to lead to positive and impactful benefits in the years ahead.

Loretta Episode 5 of Resources for a Modern Retirement focuses on getting creative in retirement and finding new passions.How are you going to spend your newfound free time in retirement? Today’s podcast introduces you to Jerry Park, who I think you will find to be an absolute inspiration. Jerry suggests:

About Our Episode Guest I don’t often talk like that. In fact, I find that I will go out of my way not to say it or even hint at it. But now since Tom Brady is back, I will state it in capital letters: I Told You So! Let me explain. If you will recall, in one of my recent blogs, I talked about trying to find a substitute for the word ‘Retirement.’ I do feel replacing (or enhancing) the word is important because the connotation is just dripping with... "it’s over! you’re a has been! you are outa here! and you have become a 'usta be!’ " Tom Brady felt it, I’m sure. After all, when he decided to quit playing football, here is how he announced it: “I am not going to make that competitive commitment anymore.” Rather fancy, huh? Kind of a dancing around the situation, right? He could not bring himself to say, “The Big R” word, so he just used some other pretty words instead. But the meaning was there: I am retiring and “imagining the possibilities.” … at least for a little while. "Acting Before Thinking is Regret"Here we are two months later, and I’m sure you heard the news: Tom Brady said Sunday he is returning to the Tampa Bay Buccaneers for his 23rd season in the NFL. The seven-time Super Bowl champion announced his decision on Twitter and Instagram, saying he has unfinished business. Uh, yeah. ‘Unfinished business.’ Ok, now maybe you will try to tell me he was made an offer he couldn’t refuse. Money? Really? Tom Brady would be swayed by the money? I doubt it. Instead, he found himself in the position that I have warned you against - namely, regretting the decision soon after leaving work and then wasting time trying to figure it all out. It can be nice during that honeymoon phase of the first few months, having no schedule or responsibility. But it’s when you start longing for connection, searching for identity and finding your purpose that the questioning and doubting begin. The TakeawayUnless you are forced out, do not leave your work until you have some idea about how and with whom you will spend your time. It is so important to get involved in some interesting, satisfying, and challenging activities OUTSIDE OF WORK many years before you plan on reaching ‘The Big R.’ Which brings me to another of my blogs: Please go back and reread my two previous blogs through the links above. Be smart, and don’t be like Tom Brady. (Has anyone ever said that before?) Contact a Retirement Coach today (maybe me?) and imagine the possibilities! Enough said, except ... I TOLD YOU SO! Loretta

P.S. If anyone out there knows Tom, please send him my contact information. I’ll be glad to help him figure things out. I recently worked with an executive who was thinking about retirement. In one of our initial sessions, I asked him about his hobbies. “HOBBIES? HOBBIES? |

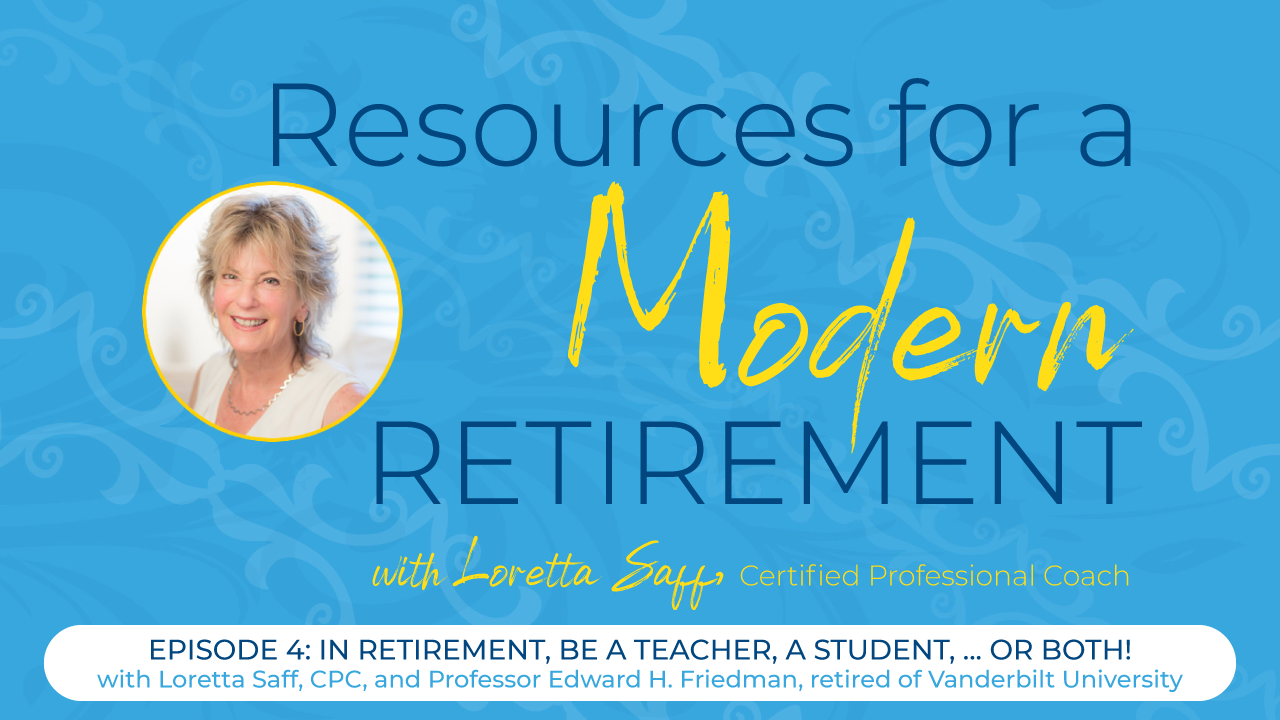

| Edward H. Friedman Retired Vanderbilt University Professor & Osher Life Long Learning Program teacher [email protected] Olli (Osher Lifelong Learing Institute) |

~~

Lately, I've gotten a lot of requests for my services as a Life/Retirement/Transition Coach. This time, I immediately thought the answer was group coaching.

Normally, I don’t share information about clients, but in order to help you understand that we need to reach out and help each other, I have obtained releases from anyone involved in this note.

Last week I held a group session with five attendees. Each had their own issues, and each was truly concerned. I’m sure you will recognize them:

Cornelia, the Candy Corn

Casper, the Friendly Ghost

Terry, the Tarantula

Peter, the Pumpkin

SLAM! There I was, face flat into the tree

“I was on my broom and one of my earbuds fell out. I had to look down to retrieve it - and SLAM! There I was, face flat into the tree. I heard people laughing! Why didn’t my radar warn me about the tree? Am I getting too old? Should I retire?”

Cornelia: She spoke softly and made eye contact with each member of the group.

“Look, as early as the 1880s I became popular. My three colorful layers are attractive, and I’m small and easy to eat.”

She teared up.

Ok, Ok, I guess I should just retire - right

She started to sob.

“I’m fat free and keep in the refrigerator for up to 9 months, but nobody really wants me now... Ok, Ok, I guess I should just retire – right?”

Casper was next.

Casper: "Yeah, it’s not rocket science. You all know me – you know me by my full name, ‘Casper the Friendly Ghost.'"

He started to smile a little, and then the smile faded.

Wanda started to snicker.

“Whoever heard of a friendly ghost?” she muttered. I had to shhh! her.

“And now there is COVID-19,” Casper continued. “People can’t even be with their regular friends, so you can bet no one wants to talk to a friendly ghost! What should I do? I have a lot of years ahead of me!”

Then it was Terry’s turn.

Terry: “Ha – you think you guys have issues? You think you don’t know what to do ‘next’? When I was a little tiny tarantula, my Mama told me I was cute. Then I left the nest, and it all ended.”

He looked around, daring people to challenge him.

He looked around, daring people to challenge him.

Everyone got quiet.

“I know, I crawl; I have long hairy legs, and I have eight eyes. But I’m harmless to people! If I bite, it’s no worse than a bee sting – okay? Look it up! So, what’s a young guy like me to do with a reputation like that?”

Wanda started muttering again. “Maybe you remind people of the COVID virus,” she whispered.

I talked over her. “Ok, Peter, it’s your turn.”

"Let's face it, the pumpkin is the

symbol for both Fall and Halloween"

His voice softened.

“But then, enter plastic and inflatables. Enter strange colors and shapes. How can I keep up with those inexpensive, use year-to-year decorations? Even on the flavor side – so many cheaper, easy-to-use imitations! In chips/pancake mix/coffee – even donuts!

People are pumpkin crazy, but they are not using the real thing!”

He looked up at me and sighed.

“And now COVID-19. There used to be pumpkin carving parties. Now no one is gathering groups together to sit close and carve. I may be able to hold out for a few more years, but I need a plan, a new direction. Should I retire?”

I let the air settle for a few minutes. Group sessions are not easy. A person (or a pumpkin) can listen and feel their issue is not so bad, or the participant can take on everyone’s problems and go away feeling worse.

I decided there was only one answer and it applied to the whole group.

“The answer for all of you is the same:

1. Decide what you really want.

2. Think of ways to reidentify yourself.

3. Find a new path to reach your goal. "

Cornelia – In what other ways can the world use candy corn?

Casper & Terry – Especially during this time of COVID-19, it’s best you stay under the radar. What if you two got together and taught a class about ghosts and spiders on Zoom?

Peter – With a legacy like yours, why not share your life story with the rest of the world? Who do you know that can help with the writing?

A person (or a pumpkin) can listen and feel their issue is not so bad, or the participant can take on everyone’s problems and go away feeling worse.

As the door shut, I heard Casper shout:

“That was amazing! Ok, everybody, MASKS ON – Let’s have a Group Hug!”

*Warning*

This blog may offend you. In it I speak to you straight,

no beating around the bush.

That said, here is my second secret:

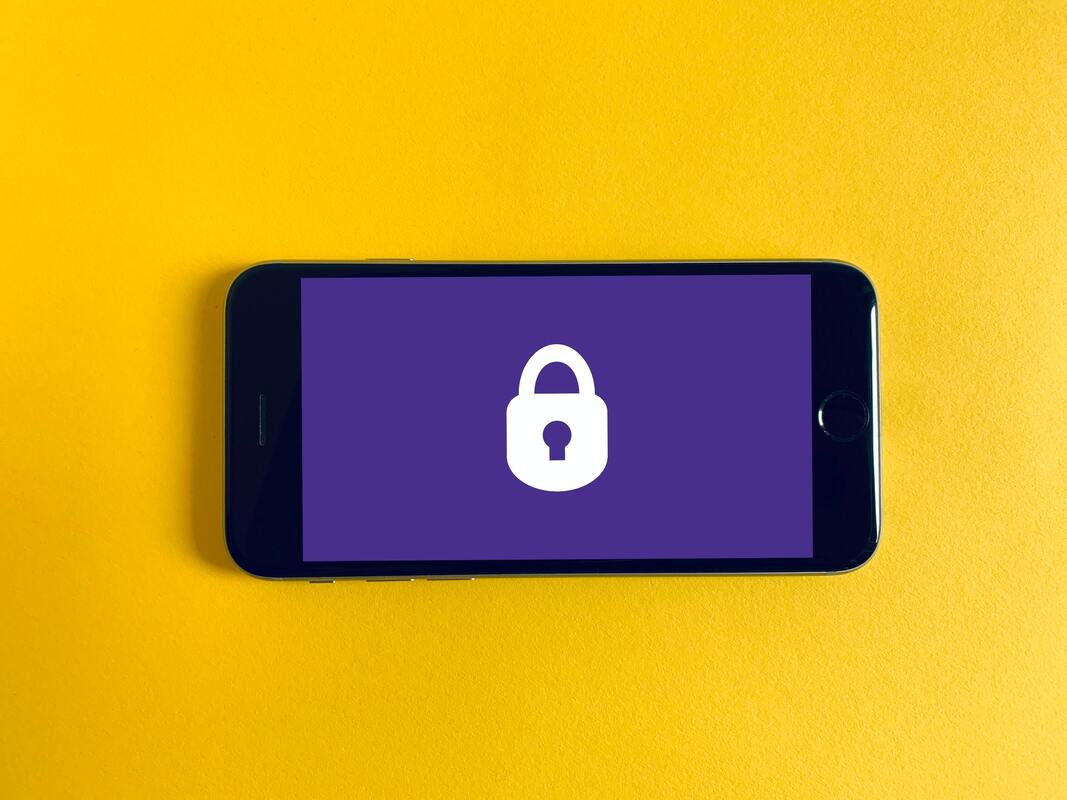

Learn How To Use Technology!

... of both the virtual world and increasingly many IRL "in real life" events as well. I'm talking about activities such as booking and confirming appointments and events with friends, doctors, restaurants / listening to music and watching TV and movies / communicating with the world outside your home.

There, I’ve said it. So put on your big boy/girl pants and get ready to learn.

Let's Start By Asking the Right Questions

Who can teach? The first people I recommend for you to turn to is your family -

- Significant Other

- Kids/Grandkids

- Aunts

- Uncles

- Cousins

- Results of ancestry.com

If those come up empty, try friends and neighbors or a volunteer organization. You may have to pay some of these people but trust me, it will be worth it. Maybe you can barter - bake/consult/garden, or offer a skill in which you excel.

The point is don’t be shy or try to overthink it. Just do it.

- The basics of the computer hardware – keyboard/screen/mouse/video camera or touchpad/power, printer, etc.

- Then, basic usage of those devices: accessing and searching the internet/reading and writing emails/ joining a Zoom meeting / accessing news or entertainment, etc.

- I am assuming you already have some sort of phone to stay in touch. Ask for lessons on how to use it beyond dialing a number, including text and instant messaging. That is how much of the world communicates now.

I don't even need or want a device.

If you are the one doing the teaching, here is a great guide to help teach tech to seniors.

Yes,I do understand that things like passwords and email addresses and saving documents and pictures can be frustrating and challenging, but getting comfortable with these technologies will lessen frustration and open a new world for you and a way to explore your curiosity and create new goals.

Go ahead – you have a new goal now. Have fun!

You're welcome,

Loretta

Episode 3 focuses on the types of questions you should be asking when choosing a financial advisor.

About our Episode Guest

Carolyn Fleury |

Author

Loretta Saff, M.A., CPC, CPRC

As an active writer, both nationally and internationally, Loretta Saff's humor columns, blog, and lifestyle articles reflect an insight in dealing with situations that helps people get to their core issues and encourage confidence, trust and support.

Categories

All

Children

Couples

Decision Making

Grandparenting

Holiday Tips

"Let's Talk Retirement"

Life Strategies

Make Happy A Habit

Modern Retirement

Parenting

Personal Empowerment

Retirement

Social Distancing

Technology

Videos

Zoom

Archives

November 2023

October 2023

July 2023

June 2023

March 2023

December 2022

November 2022

October 2022

September 2022

July 2022

May 2022

March 2022

February 2022

January 2022

December 2021

October 2021

September 2021

July 2021

June 2021

April 2021

March 2021

February 2021

January 2021

September 2020

July 2020

June 2020

April 2020

January 2020

December 2019

October 2019

July 2019

March 2019

February 2019

January 2019

September 2018

August 2018

March 2018

February 2016

RSS Feed

RSS Feed